“Our children are our most important assets and valuable possessions”, Rodney Ericson accurately states.

Having a kid is an unquantifiable experience that brings enormous joy and significance to life; this journey becomes even more enjoyable if your finances are well-planned. While some parents navigate this financial journey with easily, others struggle to achieve their children’s aspirations, whether they are long-term milestones like graduation and marriage, or short-term milestones like buying gadgets and throwing a party.

Here’s a breakdown of the various costs that a family incurs during different stages staring from nine months of pregnancy up to completing his post-graduation. This analysis seeks to provide parents, expectant couples with a clear image of how much it would cost to raise a child in our country under the given scenario.

Insights into the Calculations

The expenses outlined here are based on those of a high-earning couple living in an Indian metropolis. We provide a graph with a full breakdown of the expenses incurred during each stage. Note that your family’s real costs will vary depending on your lifestyle, geography, and other preferences. Prices have been estimated using current expense rates. It may differ depending on your child’s present age. Check the end of the repost for inflation rates.

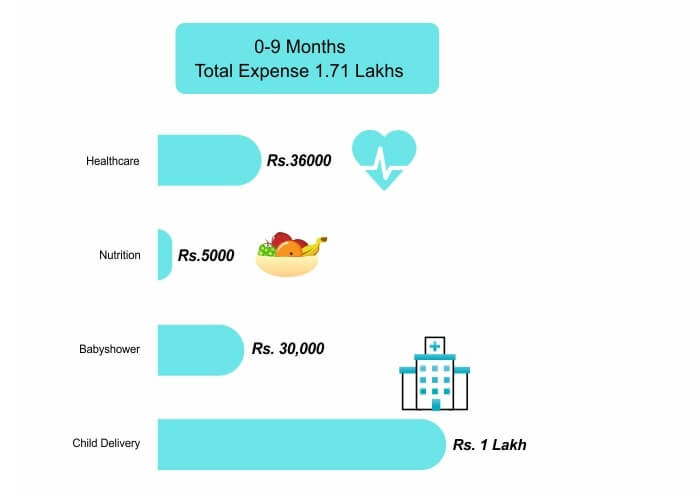

Prenatal Care & Delivery (0-9 Months)

The cost of hospitalization is the most significant expense at this point. Depending on whether you reside in a metro city, the tests you must do, and whether you have a normal or caesarean section delivery, the nine months of pregnancy and delivery expenditures can add up to a whopping Rs 2-3 lakh. Medical expenses include mothers’ vaccinations/ injections, doctors’ visits and sonographies. Additionally, monthly grocery prices will rise to satisfy the nutritional needs of the pregnant woman, which include fresh fruits, ghee, protein, and veggies. Also, rituals such as baby showers can cost anywhere from 20,000 to 1 lakh depending on the number of guests and the scale of celebration. This will be the first time that parents would be spending for seeding their child.

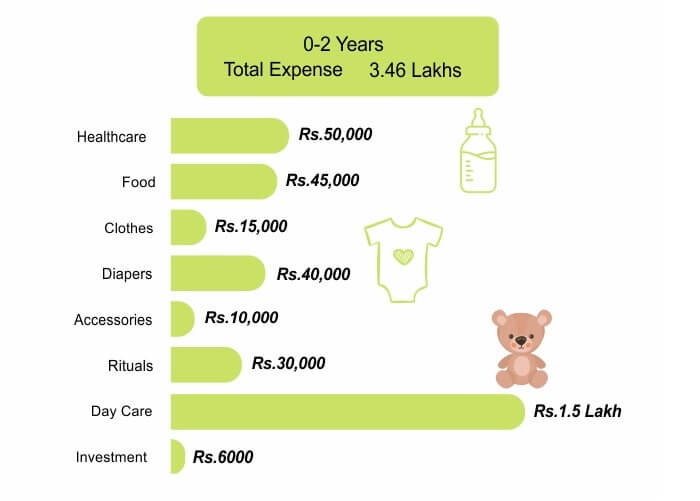

The cost of raising an infant (0-2Years)

First few years of a child’s life requires extensive medical care, as new-borns are prone to infections, including as check-ups and vaccines administered every 2 to 3 months. Apart from toys, the necessity for a variety of accessories like as a stroller, walker, and car seat arise. In addition to the first birthday party, religious activities such as naming and mundane ceremonies are held. A daycare facility can cost more than Rs 5,000 a month, and a full-time nanny Rs 10,000-12,000 a month, if both the parents are working.

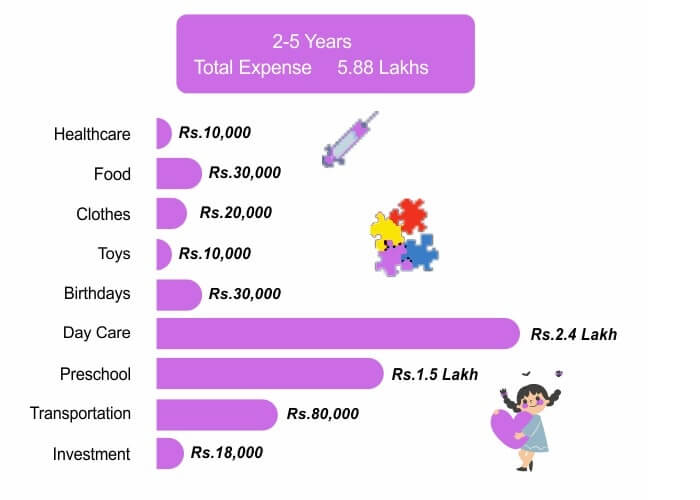

The cost of raising a toddler (2-5 Years)

Let’s examine a few key expenses during this stage. Pre-school fees can range from Rs. 50,000 to 1 lakh depending on your city, chosen pre-school brand, conveyance, after-school care, etc. As the immunity of the child is building, you will need to be prepared for routine cough and cold visits to the doctor and also include periodical vaccinations. As your child continues to grow, you will need to budget for food supplements, clothes and toys for your child.

The cost of a child during primary school (5-8 Years)

Other costs such as healthcare, diapers, infant food, and accessories decrease, while education and day care accounts for a significant portion of spending.

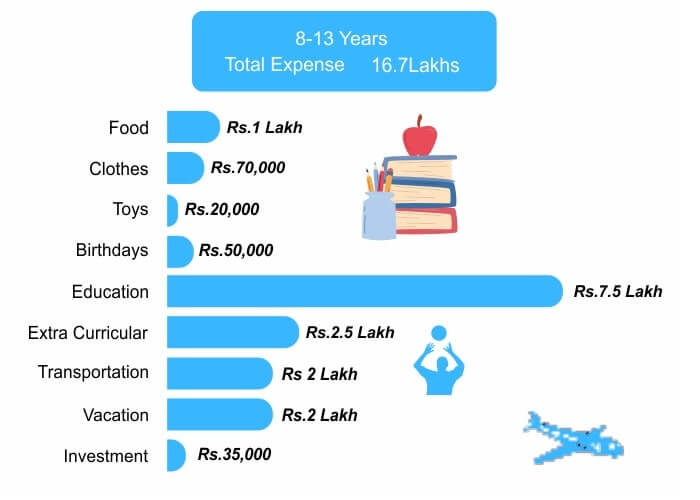

The cost of a child during middle school (8- 13 Years)

The majority of spending at this point are for education and extracurricular activities. Other expenses, such as books and uniform for your child, recreational activities and vacations will also be included in the family budget.

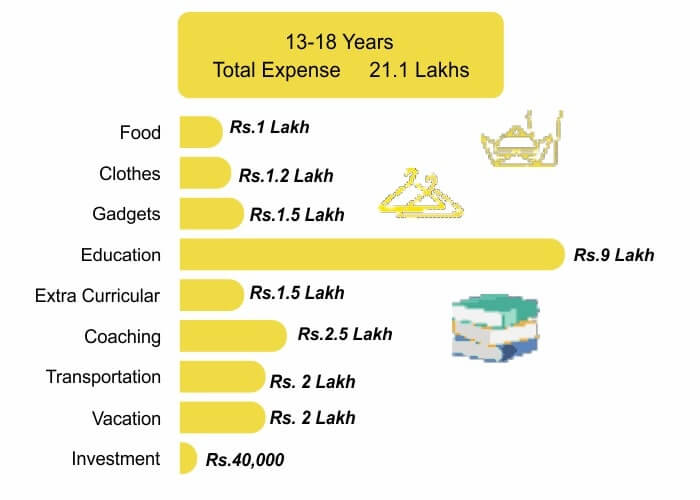

The cost of a child during high school (13-18 Years)

Let’s look at a few significant expenses at this point. Apart from school fees, you also have to pay for coaching classes, competitive exams. These are the turbulent adolescent years. Expect your youngster to be impacted by peer pressure, with demands for luxury clothes, high-end electronics, social outings, and more.

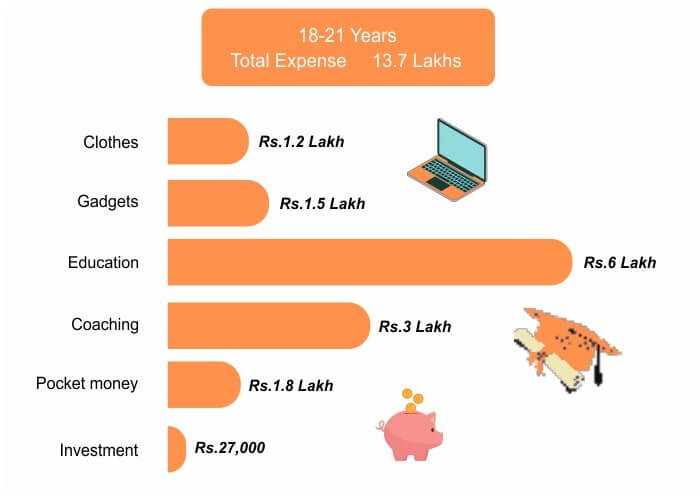

The cost of a child during college (18- 21 Years)

At this point, the costs are determined by your child’s preference of Science, Commerce or Humanities. It’s impossible to know what your child will be passionate about at the age of 5, 10, or 15 years. We have estimates cost of commerce stream for ease of calculation.

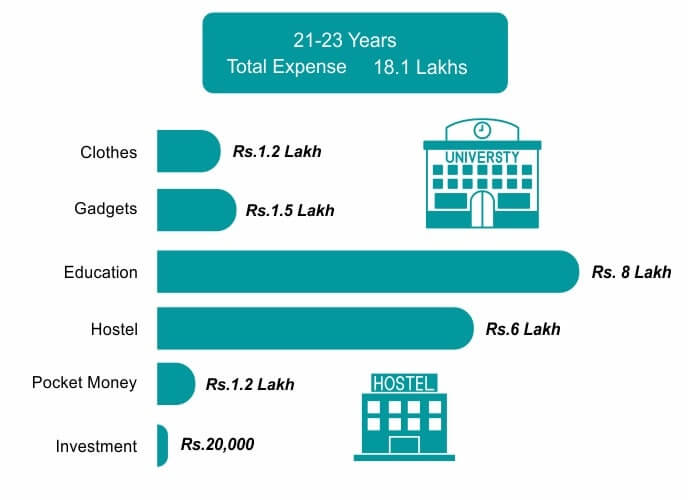

The cost of a child during post- graduation (21- 23 Years)

We assessed the prices MBA at a prestigious Indian institute. Note that, depending on the country and the course chosen, your child’s desire of an overseas higher education could cost anywhere from 40 lakhs – 50 lakhs more.

Remember to account for inflation!

When planning for a child, parents-to-be often forget to factor in the cost of inflation. This can cause a significant amount of disruption in the planning process. For example, the current cost of higher education in India for an MBA at a prestigious college is Rs. 10,00,000. Assume you and your family have a newborn. With a 7% annual inflation rate, the cost of an MBA degree will have risen to Rs. 41,40,562 by the time your child reaches 21 years old, over 4.1 times the current prices.

Key takeaways

A child offers enormous joy, but it also comes with an added financial responsibility for which you must plan ahead of time.

- Rough estimates indicate that from the time of conception until the child is old enough to live on its own, raising a child cost between Rs.80 Lakh and Rs.90 Lakh

- From the moment a child is born until they reach maturity, the expense of parenting a child only rises. As a result, you must ensure that you have covered all bases

- Most significantly, parents should consider in the cost of inflation while undertaking cost analysis so that their efforts do not go awry.

DISCLAIMER: The information provided is generic in nature and is intended solely for educational purposes. Nothing on this page should be interpreted as investing, financial, or tax advice, or as an invitation, solicitation, or marketing for any financial product. Prior to making any investment choice in connection to any financial instrument, readers should take caution and seek independent expert advice. Armstrong Capitals is not liable for any decision arising out of the use of this information.

About the Author

Manju Mastakar

The author is Managing Director of Armstrong Capital & Financial Services Pvt. Ltd. and she has over two decades of experience in Investment planning.

Armstrong Capital offers comprehensive Investment Solutions for Individuals for more details visit: www.armstrong-cap.com